Choosing MelbourneFX sets you up for success with our unique blend of features and support. We offer a user-friendly interface designed for both beginners and experienced traders. Our advanced security measures ensure your data and investments are safe. You'll have access to comprehensive educational resources and a dedicated support team ready to assist you anytime. With competitive fees, a wide range of trading options, and a commitment to your success, MelbourneFX stands out as the best choice for all your trading needs.

Yes, online trading with MelbourneFX is very safe. We implement advanced security measures to protect your investments. Our platform uses cutting-edge encryption to ensure your data remains secure and private. We are fully regulated and adhere to strict industry standards, continuously monitoring our systems to protect against any threats. With our robust security protocols, you can trade confidently knowing your assets are in safe hands.

With our transparent ultra-tight spreads, you can minimize your costs and maximize your returns.

Gain access to the world markets and trade Stocks, Forex, Crypto and more on top trading conditions.

Advanced technology is at the core of what we do so you have the right tools to reach your financial goals.

While existing solutions offer to solve just one problem at a time, our team is up to build a secure, useful, & easy-to-use platform.

Our round-the-clock E-mail, Telegram and Facebook support team will respond to you at any time, any day. Even on weekends and holidays!

Reasonable fees for takers and makers, special conditions for high-volume traders, and strong offers for market makers.

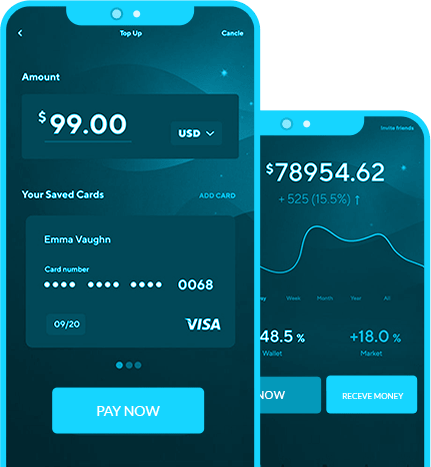

Real-time and detailed data monitoring on trades, stocks and more with clear graphical demonstration. Additional reference for users with pool data.

Adoption of PPS+ and PPLNS payment methods. Transaction fees will be paid for both methods. A setup fee so low as to guarantee safety and daily profits.

We have a ultra fast execution, tight spreads, and advanced platform features, we make to sure increase profitability.

Absolutely! MelbourneFX's platform is designed with beginners in mind. We offer user-friendly interfaces, detailed tutorials, and educational resources to help you get started. Our dedicated support team is always available to assist, ensuring you have the guidance you need to trade confidently.

Trade nowCryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (like the US dollar or Euro), cryptocurrencies operate on decentralized networks based on blockchain technology. This means they are not controlled by any central authority, making them secure and transparent. Examples of popular cryptocurrencies include Bitcoin, Ethereum, and Litecoin.

Blockchain is the underlying technology behind most cryptocurrencies. It is a distributed ledger that records all transactions across a network of computers. Each transaction is grouped into a "block," and these blocks are linked together in chronological order, forming a "chain." Because the ledger is decentralized and maintained by multiple participants (known as nodes), it is highly secure and resistant to tampering. Once a block is added to the blockchain, it is nearly impossible to alter the information it contains.

Investing in cryptocurrency can be highly volatile and risky. The value of cryptocurrencies can fluctuate dramatically over short periods, leading to significant gains or losses. While some investors have made substantial profits, others have experienced losses. It's important to thoroughly research and understand the market before investing and to only invest money that you can afford to lose. Diversifying your investments and consulting with a financial advisor can also help manage risk.

You can buy cryptocurrency through online exchanges like Coinbase, Binance, or Kraken. These platforms allow you to convert traditional money (like USD or EUR) into cryptocurrency. Once purchased, you can store your cryptocurrency in a digital wallet. There are different types of wallets, including software wallets (which can be installed on your computer or smartphone) and hardware wallets (physical devices that store your crypto offline for added security). It’s important to choose a wallet that suits your needs and to keep your private keys safe.

Bitcoin is a decentralized digital currency, often referred to as the first cryptocurrency. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Unlike traditional currencies, Bitcoin is not controlled by any central authority, such as a government or financial institution. Instead, it operates on a peer-to-peer network using blockchain technology to ensure secure and transparent transactions.

Bitcoin works through a decentralized network of computers (called nodes) that maintain a public ledger known as the blockchain. This blockchain records all Bitcoin transactions. When someone sends Bitcoin to another person, the transaction is grouped into a "block" and added to the blockchain after being verified by miners. Miners are participants in the network who use computational power to solve complex mathematical problems, securing the network and earning new Bitcoins as a reward.

The legality of Bitcoin varies by country. In many countries, including the United States, the European Union, and Japan, Bitcoin is legal and can be used for various purposes, including as a form of payment, investment, or store of value. However, some countries have banned or restricted the use of Bitcoin, citing concerns over its potential use in illegal activities, lack of regulation, or its impact on the financial system. It's important to check the laws and regulations regarding Bitcoin in your specific country.

A trading strategy is a systematic plan designed to achieve profitable returns through buying and selling financial instruments. It includes specific rules and criteria for entering and exiting trades, risk management techniques, and asset allocation. Having a trading strategy is crucial because it helps traders make informed decisions, reduces emotional trading, and provides a consistent approach to navigating the markets. A well-defined strategy can improve the chances of success and help manage risk effectively.

Leverage in trading allows traders to control a larger position in the market with a relatively small amount of capital. It is typically expressed as a ratio, such as 10:1 or 100:1. For example, with 100:1 leverage, a trader can control $100,000 worth of assets with just $1,000 of their own capital. While leverage can amplify profits, it also increases the potential for significant losses. Therefore, it's essential for traders to use leverage cautiously and understand the risks involved, including the possibility of losing more than their initial investment.

A stop-loss order is a risk management tool that allows traders to set a specific price at which their position will be automatically closed to limit potential losses. For example, if a trader buys a stock at $50 and sets a stop-loss order at $45, the position will be sold if the stock price drops to $45, thereby limiting the loss to $5 per share. Stop-loss orders are important because they help protect traders from significant losses, especially in volatile markets. By setting a stop-loss, traders can manage their risk more effectively and avoid emotional decision-making during market fluctuations. It ensures that losses are capped at a predetermined level, allowing traders to stick to their trading plan.